Accounts Receivable Finance

(Factoring)

A short-term funding method that a business can draw on using its accounts receivables.

Accounts receivable financing allows companies to receive early payment on their outstanding invoices. A company using accounts receivable financing commits some, or all, of its outstanding invoices to a funder for early payment, in return for a fee.

Get A Quote On Your Accounts Receivable Invoices

How Factoring Works

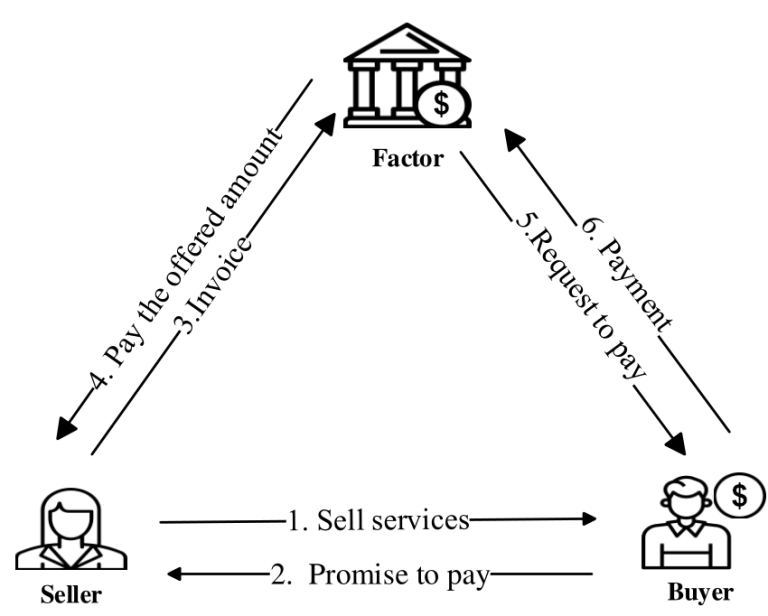

A factoring relationship involves three parties: A) a buyer, who is a person or a commercial enterprise to whom the services are supplied on credit, B) a seller, who is a commercial enterprise which supplies the services on credit and avails the factoring arrangements, and C) a factor, which is a financial institution (e.g., a bank) that benefits from the discount on invoice factoring. Typical interactions between these parties are depicted in the illustration below.

For More Info About Factoring or for Your Quote, Fill Out and Submit The Form On This Page or You Can Call Us At: 800-368-2420

© 2024 Shipley Commercial Finance

All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details and accept the service to view the translations.